Crypto Tax UK: 2024 Guide [HMRC Rules]

How does the UK tax crypto currencies? Clearly summarized, expressed in an understandable way and regularly updated. If you need a tax guide, this is it.

Blockpit employs strict editorial principles to provide accurate, clear and actionable information. Learn more about our Editorial Policy.

Key Takeaways

- Profits made from selling or disposing of cryptocurrencies are subject to Capital Gains Tax, ranging from 10%-20%.

- Any income received from cryptoassets, including payment for services, mining, or staking, is subject to Income Tax, ranging from 20%-45%.

- Tax-Free Allowances exist for CGT and Income Tax.

- Crypto losses can be used to offset crypto gains.

- HMRC distinguishes between trading (frequent, short-term buying and selling for profit) and investing (buying and holding for long-term appreciation).

Crypto Tax Basics

Crypto taxes in the UK can be challenging subject for everyone from casual HODLers to degen enthusiasts. But understanding your tax obligations is crucial. It’s not just a legal requirement – it also helps you plan your transactions and optimise your tax burden.

We’ve written this UK crypto tax guide to help you better understand the implications of your investments, provide a larger context about how tax authorities think about cryptocurrencies, and to help you make more sense of the HMRC Cryptoassets Manual.

You’ll find information about the UK tax system, the way individual types of crypto transactions are taxed, as well as guidance on how to file your crypto tax return. There’s quite a lot of content here so make sure to bookmark this page for future reference.

Make sure to also check out our crypto tax calculator to easily generate your personal compliant crypto tax report.

{{cta-banner-tax-gb="/elements/reusable-components"}}

Is There a Crypto Tax in the UK?

While cryptocurrencies are a relatively novel type of asset and the regulatory landscape is still evolving, it’s important to be aware that this doesn’t mean they are exempt from taxation in the UK.

Cryptoassets, encompassing exchange tokens, utility tokens, and security tokens, are not considered currency or money by the HMRC (His Majesty’s Revenue and Customs).

Nevertheless, the way in which these tokens are employed influences if and how they are subject to taxation.

Take Bitcoin, for example, which is classified as an exchange token. Like numerous other exchange tokens, it is utilised as a medium of exchange or payment. Consequently, if you hold cryptocurrency, including Bitcoin, as a personal investment and manage to make a profit from it, it is imperative to understand that you are obligated to pay Capital Gains Tax on those profits.

Find detailed information about the specific taxation of Bitcoin in the UK in our guide: Bitcoin Tax UK

Furthermore, if you earn cryptoassets, for instance through mining or as payment for services, this may be subject to Income Tax.

Classification of Cryptocurrency for Tax Purposes

According to HMRC, cryptocurrencies, also known as ‘cryptoassets’ or ‘tokens’, are digital assets that are securely protected with cryptographic techniques. They can be transferred, stored, and traded electronically.

It’s important to note that while all cryptocurrencies use Distributed Ledger Technology (DLT), not everything that uses DLT is necessarily a cryptocurrency.

Now, let’s break down the different types of cryptoassets:

- Exchange Tokens: These tokens are primarily intended for making payments. However, many people are also investing in them due to their potential to increase in value. Bitcoin, the most famous cryptocurrency, is an example of an exchange token.

- Utility Tokens: These are like special access passes. Holding utility tokens grants you access to specific goods or services on a platform, often powered by DLT. Businesses usually issue these tokens and accept them as payment for their services. Plus, you can trade utility tokens, much like exchange tokens.

- Security Tokens: Imagine holding a tiny piece of a business in digital form – that’s what security tokens are. They represent certain rights in a business, such as ownership, a promise of repayment, or a claim to a portion of future profits.

- Stablecoins: Picture a calm oasis in the volatile world of crypto – that’s where stablecoins come in. They are designed to have a stable value by being pegged to a more stable asset like a fiat currency (e.g., US dollars) or a precious metal (e.g., gold).

Understanding these classifications is essential as it can impact how your cryptoassets are taxed. Different types of cryptoassets might be subject to different tax rules, so knowing what you are dealing with is key to navigating the crypto tax landscape in the UK.

Why Might I Have To Pay Crypto Tax?

Cryptocurrencies, notably Bitcoin, have seen remarkable fluctuations in value since their inception. For instance, Bitcoin, which was worth mere pennies in 2008, experienced staggering surges in value, reaching approximately $20,000 in 2017 and peaking at around $67,000 in 2021.

Those who had the foresight to invest in crypto in the early days potentially amassed immense profits amounting to hundreds of millions of dollars. However, while there are still cryptocurrencies with potential out there, we are unlikely to see another coin shoot to the moon the way Bitcoin did.

In the UK, tax regulations stipulate that taxes are due on earnings that exceed certain thresholds. For the tax year 2022/23, this threshold is £12,600, while for 2023/24 it is £6,000.

This means that if the profits you earn from your crypto investments surpass these amounts, you are legally obligated to pay tax on those earnings. On the other hand, your total investment gains are tax-free if they fall below the thresholds for those tax years.

Read more about this: UK Crypto Tax-Free Allowances

Your personal opinions regarding the legitimacy or value of cryptocurrencies are inconsequential in this context. The UK government recognizes profits made from crypto investments as taxable income. Therefore, it is imperative to comply with the tax regulations and responsibly report any gains you make from trading or holding cryptocurrencies.

Do I Have to Report My Cryptoassets to HMRC?

No, there is no specific obligation to declare the holding of cryptoassets to HMRC, but you have to declare your gains, losses and income.

According to HMRC regulations, taxpayers who fail to disclose gains may be subject to a 20% Capital Gains Tax as well as interest and penalties that may total up to 200% of the taxes owed. People who are determined to have avoided paying the tax may potentially be charged with crimes and put in jail.

If you don’t submit your crypto gains to HMRC, you are playing a risky game. It is advised to correctly file all of your income and capital gains in order to maintain compliance.

You can get everything in order if you didn’t disclose your gains or losses in prior years by submitting an amended self-assessment tax return.

Capital Gains Tax for Crypto in the UK

Capital gains tax (CGT) is a tax on the profit you make when you sell or ‘dispose of’ an asset that’s increased in value – in this case, your cryptocurrencies. It’s the gain you make, not the whole amount you receive, that’s subject to tax.

Here’s some good news: the UK government offers an annual tax-free allowance, known as the Annual Exempt Amount. For the 2022/2023 tax year, this allowance is £12,300. For 2023/24 it is reduced to £6,000. This means you can make gains up to this amount in a year without paying any Capital Gains Tax.

But what if your gains exceed this amount? Well, you’ll need to pay Capital Gains Tax on the amount above the tax-free allowance. The rate you pay depends on your taxable income and the type of asset.

The tax rate for cryptocurrencies is 20% for higher rate taxpayers (those earning more than £50,270 in the 2022/2023 tax year.)

Let’s use an example to make this clearer. Say your annual income is £50,000, and you’ve made a gain of £13,000 from selling Bitcoin.

- First, subtract your tax-free allowance from your total gain: £13,000 (gain) – £12,300 (allowance) = £700. This £700 is your taxable gain.

- As a higher rate taxpayer, your Capital Gains Tax rate for cryptocurrencies is 20%. So, you’ll pay 20% tax on the £700, which equals £140.

So in this case, you’d owe £140 in Capital Gains Tax on your Bitcoin sales.

<figure class="block-table">

<table>

<thead>

<tr>

<th>Tax Bracket</th>

<th>Income Range</th>

<th>CGT Rate on Assets</th>

<th>CGT Rate on Property</th>

</tr>

</thead>

<tbody>

<tr>

<td>Basic Rate</td>

<td>£12,571 – £50,270</td>

<td>10%</td>

<td>18%</td>

</tr>

<tr>

<td>Higher Rate</td>

<td>£50,271 – £125,139</td>

<td>20%</td>

<td>28%</td>

</tr>

<tr>

<td>Additional Rate</td>

<td>Over £125,140</td>

<td>20%</td>

<td>28%</td>

</tr>

</tbody>

</table>

<figcaption>Capital Gains Tax Rates 2023</figcaption>

</figure>

Crypto Transactions That Fall Under Capital Gains Tax

- Selling crypto in exchange for Fiat (including rewards from Staking, Lending, Liquidity Mining, Airdrops e.g.)

- Swapping crypto for crypto (including rewards from Staking, Lending, Liquidity Mining, Airdrops e.g.)

- Gifting crypto (except to your spouse or civil partner)

- Spending crypto on goods and services

- Selling NFTs

Calculation of Gains and Losses

Calculating your gain typically involves finding the difference between what you paid for a crypto asset and what you sold it for. If you obtained the asset without payment, the market value at the time of acquisition is used to compute the gain.

However, no Capital Gains Tax is due on the value of the tokens you’ve already paid Income Tax on, but you will have to pay the tax on any gain you make after receiving them.

You can reduce your gain – and thereby your tax burden – by deducting certain allowable costs. These include transaction fees paid before the transaction is added to a blockchain, costs for advertising for a buyer or seller, costs involved in drawing up a contract for the transaction, and costs for making a valuation to work out your gain for that transaction.

Do keep in mind, though, that you cannot deduct costs you’ve already deducted against profits for Income Tax or costs of mining activities, such as equipment or electricity.

Capital Gains Tax Free Allowance

The tax free allowance allows you to make a certain amount of gain from selling your cryptoassets without owing any Capital Gains Tax (CGT).

For the tax year 2022/23, the Capital Gains Tax-Free Allowance was set at £12,300 for individuals and personal representatives.

For most trustees, the allowance was halved, standing at £6,150. This means that during this tax year, you could make gains of up to £12,300 from selling your cryptoassets without having to pay any Capital Gains Tax.

For the tax year 2023/24, the Capital Gains Tax-Free Allowance has been reduced to £6,000 for individuals and personal representatives, and it’s £3,000 for most trustees.

This change means you need to be more cautious and strategic with your crypto transactions, as the buffer before you start incurring CGT is now smaller.

You can find everything you need to know about tax allowances here: UK Crypto Tax-Free Allowances

Income Tax for Cryptocurrency

Any income you receive from cryptoassets is subject to Income Tax. Whether you’re paid in Bitcoin for a service you provide, or you’ve earned coins from mining or staking, these are all taxable events.

When you receive cryptocurrency as payment for goods or services, the income you report should be the value of the cryptocurrency in pounds at the time you received it. This could be your hourly rate if you’re a freelancer, the value of the goods you’ve sold, or the market value of the crypto you’ve received.

When it comes to crypto mining taxes or crypto staking taxes, things get a bit more complex.

If your mining activity constitutes a professional activity (for example, you have significant equipment or energy costs, and the intention to make a profit), any profits will be subject to Income Tax under trading income rules. If your activity is more casual, the crypto you earn might be subject to Income Tax as miscellaneous income.

Read this to learn if your crypto transactions constitute a trade: UK Crypto Tax – Investor or Trader?

Now, you might be wondering, “How much tax do I need to pay on crypto?” This depends on your overall income for the tax year.

As of the 2022/2023 tax year, the basic rate (20%) applies to income up to £50,270, the higher rate (40%) applies to income between £50,271 and £150,000, and the additional rate (45%) applies to income over £150,000.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">According to the Autumn Statement the threshold for the additional rate is lowered from £150,000 to £125,140 from April 2023.</p></div></div></div>

Let’s look at an example to make this clear.

Say you’re a freelancer with an annual income of £30,000, and you’ve been paid £5,000 worth of Bitcoin for a project. Your total income for the year is now £35,000, which still falls within the basic rate band. Therefore, you’d pay 20% tax on your Bitcoin earnings, which equals £1,000.

<figure class="block-table">

<table>

<thead>

<tr>

<th>Tax Bracket</th>

<th>Income Range</th>

<th>Income Tax Rate</th>

</tr>

</thead>

<tbody>

<tr>

<td>Personal Allowance</td>

<td>Up to £12,570</td>

<td>0%</td>

</tr>

<tr>

<td>Basic Rate</td>

<td>£12,571 – £50,270</td>

<td>20%</td>

</tr>

<tr>

<td>Higher Rate</td>

<td>£50,271 – £125,139</td>

<td>40%</td>

</tr>

<tr>

<td>Additional Rate</td>

<td>Over £125,140</td>

<td>45%</td>

</tr>

</tbody>

</table>

<figcaption>Income Tax Rates 2023</figcaption>

</figure>

Crypto Transactions That Fall Under Income Tax

Learn more about Income Tax and Capital Gains Tax in our guide: UK Crypto Tax Rates

Inheritance tax for cryptocurrency in the UK

In the United Kingdom, Inheritance Tax applies to the estate of a deceased person, including cryptocurrency holdings. Cryptocurrencies are considered assets and are subject to Inheritance Tax if the total value of the estate exceeds the threshold of £325,000.

The value of cryptocurrency holdings should be converted to pounds based on the market price on the date of death. Record-keeping is essential as HMRC may request this information.

Certain reliefs or exemptions might reduce Inheritance Tax. For instance, leaving assets to a spouse, civil partner, charity, or community amateur sports club can eliminate Inheritance Tax.

Additionally, ‘taper relief’ might apply for assets gifted within seven years before death.

There’s also a potential increase in the Inheritance Tax threshold if a home is left to children or grandchildren, known as the residence nil rate band (RNRB).

Inheritance Tax, where due, is paid by the estate’s executor or administrator within six months from the end of the month of death. Beneficiaries don’t pay this tax personally; it’s deducted from the estate.

Considering the complexity of Inheritance Tax, especially with cryptocurrency involved, consulting a solicitor or tax advisor experienced in estate planning is recommended to ensure compliance and efficient estate management.

Value Added Tax (VAT) for cryptocurrency in the UK

According to the HMRC, the exchange of cryptocurrencies for traditional currency is exempt from Value Added Tax (VAT).

This exemption is in line with a ruling by the Court of Justice of the European Union (CJEU) in the Hedqvist case, which established that Bitcoin and other cryptocurrencies should be treated similarly to traditional currencies for VAT purposes.

The ruling has been incorporated into the UK’s VAT legislation under Schedule 9 Group 5 of the VAT Act 1994. Essentially, this means that when you buy cryptocurrencies, you are not required to pay VAT on the actual coins or tokens.

How about other kinds of transactions?

Crypto Mining: If you are engaged in mining cryptocurrencies, the cryptoassets you obtain are generally exempt from VAT. This applies if the activity has no direct link between the services provided and any payment received, and that there is no customer for the mining service.

Goods and Services Transactions: When you use cryptocurrencies to pay for goods or services, no VAT is charged on the cryptocurrency itself. However, the normal VAT rules apply to the goods or services being purchased.

For example, if you buy a laptop using Bitcoin, you won’t pay VAT on the Bitcoin, but you will pay the standard VAT on the laptop.

Transaction Fees: If you are charged any fees for organising or carrying out transactions in cryptoassets that are separate from the value of the cryptocurrency, these fees are also exempt from VAT.

{{cta-banner-tax-gb="/elements/reusable-components"}}

Taxation of Crypto Transactions

Taxable events for crypto transactions in the UK

Selling Crypto for Fiat

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Selling your cryptocurrency for fiat (like pounds or dollars) is indeed a taxable event in the UK. The tax you may owe is called Capital Gains Tax. It’s calculated on the profit you make when you sell your crypto, not the total amount you receive. This profit is the difference between the amounts for which you bought the crypto and for which you sold it.

But what if you’re not just investing in crypto, but trading it? Here’s where it gets interesting.

HMRC makes a distinction between trading and investing. Trading involves frequent and short-term buying and selling with the intent of making profit from market fluctuations.

Investing, on the other hand, is when you buy and hold a cryptocurrency for a longer term, hoping that it increases in value.

If you’re considered a trader by HMRC, your crypto activity could be classified as a trade and would then be subject to Income Tax rather than Capital Gains Tax. Income Tax rates can be higher than Capital Gains Tax rates, depending on your total taxable income, and there’s no equivalent of the Annual Exempt Amount. If you incur trading losses, these might be deductible from your capital gains.

HMRC looks at several factors to determine if you’re trading or investing, including the level of organisation involved, the number of transactions made, and the intention to profit from short-term market fluctuations. This is done on a case-by-case basis.

However, most individual investors are likely to be considered just that – investors. This means your crypto activity will most likely be subject to Capital Gains Tax.

Trading Crypto for Crypto (including stablecoins)

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Trading one cryptocurrency for another, including stablecoins, is a taxable event in the UK.

Why? Because HMRC views cryptocurrencies as an asset. When you swap one crypto for another, you’re ‘disposing’ of the first asset, and this triggers Capital Gains Tax.

To calculate the tax, you need to convert the value of the crypto you traded into pounds sterling at the time of the trade, and calculate your gain or loss compared to its original cost.

Example: You bought 1 Ethereum for £1,000 and later traded it for Bitcoin worth £1,500. Your gain is £500, which may be subject to Capital Gains Tax.

Spending Crypto on Goods and Services

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Spending cryptocurrency on goods and services is considered a taxable event in the UK.

Here’s the deal: HMRC views cryptocurrency not as currency, but as an asset. When you use crypto to buy something, you are effectively ‘disposing’ of that asset. This means you could be subject to Capital Gains Tax on the difference between what you originally paid for the crypto and its value at the time you spent it.

Imagine you bought 0.01 Bitcoin for £100 some time ago. Today, that 0.01 Bitcoin is worth £200, and you decide to buy a fancy gadget with it. In this scenario, you made a gain of £100 (£200 – £100), and this gain is subject to Capital Gains Tax.

Gifting Crypto

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div><br>

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Gifting cryptocurrency can be a taxable event.

Here’s why: Similar to spending crypto on goods or services, gifting crypto is considered as ‘disposing’ of an asset by HMRC. This means that you could be subject to Capital Gains Tax on the difference between what you originally paid for the crypto and its market value at the time you gifted it.

For example, let’s say you bought 0.05 Bitcoin for £500 a while ago. Now, it’s worth £800, and you decide to gift it to a friend. You’ve made a gain of £300 (£800 – £500), and this gain may be subject to Capital Gains Tax.

However, there’s an important twist when it comes to gifting crypto to your spouse or civil partner.

Transfers between spouses or civil partners are not usually subject to Capital Gains Tax at the time of the gift. Instead, the recipient takes on the original cost basis and will be liable for any Capital Gains Tax if they later dispose of the crypto.

Mining Crypto

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

Mining cryptocurrency is considered a taxable event in the UK.

Here’s the scoop: HMRC generally views the activity of mining as a form of income. When you successfully mine cryptocurrency, you’re earning assets, and this is similar to receiving a payment. This income is subject to Income Tax.

The amount of tax you’ll need to pay depends on the value of the cryptocurrency at the time you mined it. It’s important to record the market value in pounds sterling on the date you received the mining reward.

But wait, there’s more. If you later decide to sell or exchange the cryptocurrency you mined, and its value has increased, you may also need to pay Capital Gains Tax on the profit you made from the increase in value.

For example, let’s say you mined 0.2 Bitcoin when it was worth £2,000. You would record this as income. Later, you sell it when it’s worth £3,000. The £1,000 increase in value is considered a capital gain and could be subject to Capital Gains Tax.

What’s more, if your mining operation is extensive and organised with an intention to make profits, HMRC might classify it as a trade, which could have different tax implications.

Learn more about crypto mining in the UK in our guide: UK Crypto Mining Tax.

Receiving Crypto via Airdrop

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

<br>

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Receiving cryptocurrency through an airdrop can indeed be a taxable event in the UK.

Here’s how it works: No Income Tax is owed when someone receives a cryptocurrency allocation as part of, say, an advertising campaign provided it is given without expecting anything in return and is not used to operate a business.

When a person performs a service for the airdrop, also known as a bounty, the money is typically taxable as other income. In this case, you may have to pay Income Tax on the value of those tokens at the time they were airdropped into your crypto wallet.

For instance, if you received 100 tokens from an airdrop, and at the time they were worth £200, this amount might be considered as income and could be subject to Income Tax.

If the value of those tokens increases and you decide to sell or exchange them, you may also have to pay Capital Gains Tax on the profit. For example, if the value of the airdropped tokens rises to £300 and you sell them, you may need to pay Capital Gains Tax on the £100 profit.

Learn more about this topic: UK Airdrop Taxation.

Receiving Crypto from Hard Forks

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

A “hard fork” refers to a situation where there is a significant change to the blockchain protocol, resulting in the creation of a new cryptocurrency alongside the original one.

According to HMRC, the mere occurrence of a hard fork does not, in itself, constitute a disposal of the original cryptocurrency. This means that when a hard fork occurs, and you receive new cryptocurrency as a result, it doesn’t count as if you’ve sold or gotten rid of the original cryptocurrency.

Additionally, HMRC indicates that the allowable costs associated with acquiring the original cryptocurrency need to be apportioned between the original cryptocurrency and the newly created cryptocurrency. In simpler terms, this means that the costs you initially incurred to acquire the original cryptocurrency should be divided between the original and the new cryptocurrencies.

This allocation is necessary for tax purposes, especially when you eventually sell or exchange either the original or the new cryptocurrency, as it helps in determining the gain or loss for Capital Gains Tax calculations.

For instance, if you initially acquired a cryptocurrency for £1,000 and a hard fork occurs, resulting in you receiving new cryptocurrency, you will need to allocate the original £1,000 cost between the two cryptocurrencies.

This allocation is crucial for understanding the base cost of each cryptocurrency, which will be used to calculate any capital gains or losses when you decide to sell them.

Receiving Crypto as a Gift

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

You generally do not have to pay tax at the moment you receive the cryptocurrency as a gift.

However, if you later sell, exchange, or otherwise dispose of the cryptocurrency, you may have to pay Capital Gains Tax on any increase in value since you received it.

One more thing: Inheritance Tax. If the total value of the gifts given by an individual in the seven years before their death exceeds the Inheritance Tax threshold (currently £325,000), Inheritance Tax may be due on those gifts, and this includes cryptocurrency.

Staking & Lending Crypto

HMRC has updated its Cryptoasset Manual with new insights on the tax implications of using cryptoassets in decentralised finance (DeFi) transactions. This guidance addresses key tax queries related to DeFi, including the nature of returns from DeFi activities and the timing of taxable events when cryptoassets are lent or staked.

One essential point in the HMRC’s guidance is that when cryptoassets are lent or staked on a DeFi platform, and other tokens are received from the platform in return, this is generally considered a disposal for tax purposes.

This is the case if the person lending or staking has transferred the beneficial interest in their tokens. This also applies to a borrower who offers tokens as collateral for a loan.

It’s important to note that this analysis is based on specific facts and relies on various factors such as the nature of the smart contracts involved and the underlying technology of the tokens that are lent or staked. Interestingly, this means that a tax liability could arise even if the person lending or staking doesn’t receive any returns at the moment of disposal.

Additionally, HMRC has clarified that it doesn’t view the returns earned by the person lending or staking cryptoassets as interest for tax purposes.

As a result, tax provisions specifically applicable to interest do not apply to these returns. The tax treatment of the returns will be based on whether they are deemed capital or revenue in nature.

Furthermore, in a bid to make the UK more appealing for crypto-related businesses, the UK government has announced plans to reevaluate the tax treatment of DeFi lending and staking activities.

In summary, HMRC’s recent guidance suggests that lending or staking cryptoassets in DeFi transactions generally constitutes a disposal for tax purposes. The tax treatment of returns from these activities is contingent on the specifics of each transaction and whether the returns are considered capital or revenue.

We’ve written a full guide to help you navigate staking taxes. Read it here: UK Staking Tax

Minting NFTs

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

While there aren’t explicit rules specifically for the creation of NFTs, it’s generally considered that minting them doesn’t trigger a taxable event. When NFTs are sold, they are usually treated like other cryptoassets for tax purposes, and the same tax rules apply.

It’s important to understand that the exact tax treatment of NFTs can vary depending on their specific attributes, functionalities, and characteristics, and each case is evaluated individually.

The tax status is not determined merely by categorization as an NFT, but by the intrinsic qualities it holds.

For instance, if the NFT doesn’t confer any ownership rights over underlying assets, it’s likely to be treated similarly to other cryptoassets in terms of taxation. However, if an NFT has unique features, such as conferring ownership rights in underlying assets, then different tax considerations may come into play.

Buying NFTs

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

When you simply buy an NFT, there is no immediate tax liability.

Depending on the specifics, you might need to pay VAT on the purchase price of the NFT. This is similar to sales tax and is usually included in the price you pay for the NFT. If you’re buying from an international seller, make sure to check if any additional VAT is due.

It’s important to understand that the exact tax treatment of NFTs can vary depending on their specific attributes, functionalities, and characteristics, and each case is evaluated individually.

The tax status is not determined merely by categorization as an NFT, but by the intrinsic qualities it holds.

For instance, if the NFT doesn’t confer any ownership rights over underlying assets, it’s likely to be treated similarly to other cryptoassets in terms of taxation. However, if an NFT has unique features, such as conferring ownership rights in underlying assets, then different tax considerations may come into play.

Selling NFTs

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

In the UK, selling NFTs has tax implications that you should be aware of. Let’s go through the essentials:

When you sell an NFT, you are likely to be subject to Capital Gains Tax on any profit you make.

This is the tax on the gain you make from selling the NFT compared to what you originally paid for it.

For example, if you bought an NFT for £500 and sold it for £2,000, your capital gain would be £1,500 (£2,000 – £500). This gain is what’s potentially subject to CGT.

Details about the annual exempt amount and the rate you’ll pay for CGT can be found in our guide: UK crypto tax rates.

If you sell an NFT for cryptocurrency, this is still considered a taxable event. You’ll need to calculate the value of the cryptocurrency in pounds sterling at the time of the sale to work out your capital gain.

Generally, as a private individual, you’re not required to charge VAT when you sell an NFT. However, if you’re running a business that deals with NFTs, different VAT rules might apply.

We’ve written a whole guide about NFT taxation in the UK as well. Read it here: UK NFT Tax

Liquidity Mining Rewards

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

According to HMRC, in some situations, Liquidity Mining rewards may be classified as income. This classification is more likely when the return to be received is predetermined rather than being uncertain and speculative, when it is paid by the borrower or DeFi platform, and when it is distributed consistently throughout the lending or staking period.

Consequently, if you are receiving new tokens or coins on a regular basis as a result of your DeFi activities, there’s a higher likelihood that this will be considered earned income and be subject to Income Tax.

In this case, you need to calculate your rewards value in pounds sterling at the time you receive them. This is the amount that will be considered as income.

You might also need to pay NICs on the rewards if they’re classified as earnings from self-employment. This could depend on various factors, including how involved you are in liquidity mining activities.

When you eventually sell the tokens you received as liquidity mining rewards, you might also incur Capital Gains Tax on any profit you make compared to their value when you received them.

If you’re staking your liquidity provider tokens to earn additional rewards, these rewards are also likely to be considered as income and taxed accordingly.

Adding or Removing Liquidity to/from Liquidity Pools

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

If you’re investing in these pools, you might initially perceive this as merely shifting your crypto from one location to another, given that you’re not really getting rid of the asset.

However, HMRC has a different take on it.

According to them, if you obtain a liquidity pool token by contributing your cryptocurrency, this counts as a disposal. What you need to do is calculate your cost basis by summing up the value of the tokens you have contributed to the pool. Next, deduct this total from the fair market value of the tokens at the time of disposal. This figure will then serve as the cost basis for your liquidity pool tokens, which is essential to know for when you decide to withdraw them from the pool.

Lost or Stolen Cryptoassets

<div fs-richtext-component="tax-status-tax-deductable" class="tax-status-pills"><div>Potentially Tax Deductable</div></div>

When a person loses access to their cryptoassets due to misplacement of their private key (such as losing the physical document where it was written), it is important to note that this does not constitute a disposal of the assets for Capital Gains Tax purposes.

The rationale is that the private key continues to exist cryptographically, and the tokens remain on the distributed ledger, even though the owner can no longer access them.

However, in cases where it can be demonstrated that there is no possibility of recovering the private key and accessing the tokens, the person may make a negligible value claim.

If HMRC accepts this claim, the person will be treated, for tax purposes, as having disposed of the tokens and immediately re-acquired them at a negligible value. This allows the individual to realise a loss, which can be relevant for tax calculations.

For more comprehensive information, you can refer to HMRC guidance documents CG13155 and CRYPTO22500.

Cryptocurrency as Employment Income

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

When cryptocurrency is received as employment income, HMRC considers it to be similar to receiving a salary. The employer needs to calculate the value of the cryptocurrency in pounds at the time it is received. This value is subject to Income Tax and National Insurance contributions.

Employers are required to report this through the Pay As You Earn (PAYE) system, and they are responsible for deducting the necessary taxes before the cryptocurrency is handed over to the employee.

As an employee, it’s important to keep records of the cryptocurrency received and its value in pounds, ensuring that your employer is fulfilling their tax obligations.

Cryptocurrency as Self-Employment Income

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

For those who are self-employed and receive cryptocurrency as payment for services or running a business, it’s necessary to report this income as self-employment income. Keep in mind that you need to maintain records of all transactions and their value in pounds at the time of receipt.

When filing your Self Assessment tax return, include details of your self-employment income. If you have incurred any business-related expenses, you may deduct them, but make sure to keep records. It’s also beneficial to have separate records for cryptocurrency transactions to ease the reporting process.

{{cta-banner-tax-gb="/elements/reusable-components"}}

Optimising Your Crypto Taxes

In the UK, while it’s unwise to hide cryptocurrency from HMRC, shrewd investors employ legal tax strategies to reduce their crypto taxes.

Using Crypto Tax Software

These tools simplify the complex task of tracking your cryptocurrency transactions. They provide real-time insights and accurate calculations of tax liabilities. By using such software, you can ensure that you're claiming all the deductions and credits you're entitled to, potentially lowering your tax bill.

Tax Loss Harvesting

This strategy involves deliberately selling cryptocurrencies that have decreased in value to offset the gains from other investments. This method can lower your taxable income and reduce your capital gains tax. However, it requires understanding the specific rules for matching losses to gains and may require timing your sales appropriately.

Carry Forward of Losses

If your losses exceed your gains in a tax year, you can carry forward these losses to offset future gains. This can be especially useful in years when you have high capital gains. It's important to keep detailed records, as these losses can be carried forward indefinitely but cannot be used to offset other types of income.

Utilise Allowances

The UK offers a tax-free capital gains allowance each year. By realising gains within this allowance, you can avoid paying Capital Gains Tax on those gains. This requires careful planning to ensure your gains stay within the allowable limit.

Consider Timing of Sales

The timing of your cryptocurrency sales can significantly affect your tax liabilities. By selling assets in a year when your overall income is lower, you might reduce your overall tax rate or stay within a lower tax bracket.

Gift Cryptocurrency

Gifting crypto to a spouse or civil partner can be a tax-efficient way to transfer assets. The recipient can potentially sell the assets and use their own tax allowance, which can be particularly beneficial if they are in a lower tax bracket.

Donate Cryptocurrency

Donating to charity can reduce your taxable income. If you donate appreciated cryptocurrency, you might be able to deduct the market value of the donation, potentially reducing your overall tax liability. However, it's important to note that capital gains tax may still apply if the crypto has appreciated in value since you acquired it.

Consider Your Income Bracket

Your tax rate for capital gains can vary depending on your income level. By understanding your income bracket, you can make informed decisions about when to sell assets, potentially benefiting from lower tax rates.

Keep Accurate Records

Maintaining detailed records of all your transactions is crucial for accurately reporting taxes and claiming deductions. This includes tracking the dates of transactions, amounts, and the value of the cryptocurrency at the time of each transaction.

Consult a Tax Professional

A tax advisor with experience in cryptocurrency can provide customized guidance. They can help navigate the complexities of crypto taxes, identify tax-saving opportunities, and ensure compliance with current regulations.

Be sure to have a look at our guide “How to avoid crypto taxes in the UK” for more information and detailed explanations.

{{cta-banner-tax-gb="/elements/reusable-components"}}

Automating & Filing Your Tax Report

Can HMRC track cryptocurrencies and crypto transactions?

When it comes to cryptocurrency transactions, many individuals are curious about the extent to which HMRC can monitor these transactions. It’s essential to understand that, despite the pseudonymous nature of cryptocurrencies, HMRC has been steadily increasing its efforts to track transactions for crypto tax compliance.

Firstly, blockchain technology, which underpins most cryptocurrencies, is inherently transparent. This means that transactions on the blockchain can be viewed by anyone. While the identity of the parties involved is not directly revealed, patterns and other data can be analysed to make connections.

Furthermore, HMRC has been known to request customer information from cryptocurrency exchanges. Many exchanges operating in the UK are required to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which means they collect personal information on their users. If HMRC requests this information, the exchanges are likely to comply.

Moreover, HMRC uses technology to analyse data and track transactions. They have invested in web scraping tools and blockchain analysis software, which can de-anonymize wallet addresses and establish connections between cryptocurrency transactions and individuals.

HMRC has dispatched letters, known as ‘nudge’ letters, to individuals investing in cryptocurrency, encouraging them to fulfil their obligations by paying capital gains and Income Tax.

There are lots of new developments regarding crypto regulation in the UK and around the world. Read all about it here: Crypto & Tax Authorities.

Do crypto exchanges report to HMRC?

In the United Kingdom, cryptocurrency exchanges have been actively participating in a data-sharing program facilitated by HMRC. This collaboration dates back to as early as 2014, and involves sharing transaction data and Know Your Customer (KYC) information that users provide when registering on a UK-based exchange or wallet service.

A pivotal moment occurred a few years ago when HMRC officially acknowledged its collaboration with major cryptocurrency exchanges to access customer data through KYC identification documents. Leveraging this information, HMRC took proactive steps to communicate with cryptocurrency investors by sending out ‘nudge’ letters.

In January 2022, Coinbase, one of the major cryptocurrency exchanges, began sending emails to its clients holding more than £3,000 in cryptocurrency. These emails notified clients that their account information would be shared with HMRC. Furthermore, in March 2023, in accordance with the Finance Act, Coinbase started notifying UK clients who had received payments exceeding £5,000 in fiat currency that the company had shared information about their accounts with HMRC.

As a user of cryptocurrency exchanges in the UK, it is imperative to be aware of these data-sharing practices. The information you provide to exchanges is not isolated, and HMRC may access it in their efforts to ensure tax compliance. As such, ensuring accurate reporting of cryptocurrency transactions and holdings is vital to fulfilling your tax obligations in the UK.

Record-Keeping Requirements for Crypto Tax in the UK

Types of Records Required for Tax Purposes

For each transaction involving cryptocurrency, you must meticulously maintain the following records:

- Type of tokens: Clearly indicate the specific cryptocurrency involved in the transaction (e.g., Bitcoin, Ethereum).

- Date you disposed of them: Record the date on which you sold, traded, or otherwise disposed of the cryptocurrency.

- Number of tokens you’ve disposed of: Detail the quantity of cryptocurrency tokens involved in the transaction.

- Number of tokens you have left: Keep track of the remaining balance of cryptocurrency tokens after the transaction.

- Value of the tokens in pound sterling: Document the value of the tokens in GBP at the time of the transaction.

- Bank statements and wallet addresses: Maintain copies of bank statements and wallet addresses involved in the transaction for verification purposes.

- A record of the pooled costs before and after you disposed of them: Track the pooled costs of your tokens both before and after the transaction. This is essential for calculating your gains or losses.

Additionally, it is advisable to keep other ancillary records such as wallet addresses for thorough documentation.

It is vital to understand that HMRC may conduct compliance checks and, in such cases, they may request to see your transaction records. Keeping comprehensive records not only facilitates easier and more accurate reporting at tax time, but also ensures that you are prepared in the event of an HMRC inquiry.

Retention Periods for Records

The period for which you are required to retain your cryptocurrency tax records is contingent on whether you file your tax returns by the deadline or afterwards. It is imperative to be cognizant of these retention periods, as HMRC may request to inspect your records to verify that you have paid the correct amount of tax.

For tax returns submitted on or before the due date, you must retain your records for a minimum of 22 months following the end of the tax year for which the tax return was filed.

For instance, if you submit your tax return for the 2022 to 2023 tax year electronically by the deadline of January 31, 2024, you must keep your records until at least the end of January 2025.

In contrast, for tax returns submitted after the deadline, the retention period is slightly shorter. In these cases, you must retain your records for at least 15 months after the submission of your tax return.

Understanding and adhering to these record retention periods is crucial for compliance with HMRC regulations. It’s advisable to have a systematic approach to record-keeping and be vigilant about deadlines to avoid any complications or penalties.

Consequences of Inadequate Record-Keeping

Firstly, penalties could be imposed by HMRC. The amount varies depending on the nature of the error. If HMRC believes there’s an element of carelessness or deliberate deception, the penalties could be severe.

Inadequate records can lead to increased scrutiny from HMRC. This is often viewed as a sign of non-compliance and may result in more frequent checks.

Additionally, poor record-keeping can create challenges in accurately calculating your tax liability. Without detailed records, you might underpay or overpay your taxes.

In extreme cases, if inadequate records are part of tax evasion or fraud, you could face legal consequences including prosecution or even imprisonment.Lastly, there’s the risk of reputational damage. Being associated with tax non-compliance can have adverse effects on your standing with financial institutions.

UK Cost Basis Methods

In the context of cryptocurrency trading, it is essential to understand the cost basis methods prescribed by HMRC for calculating capital gains and losses. These methods are particularly relevant for investors engaging in multiple trades involving identical assets.

HMRC mandates the use of share pooling as the crypto cost basis method. Share pooling is implemented to prevent investors from manipulating the Average Cost Basis (ACB) method by engaging in rapid buy-and-sell transactions, which could distort the representation of gains and losses.

There are three cost basis methods specified by HMRC, which must be applied in the following order:

1. Same-Day Rule

Under this rule, if an investor buys and sells the same cryptocurrency on the same day, the cost basis used to calculate gains or losses is based on the value of the assets on that specific day. If the quantity sold exceeds the quantity bought on the same day, the investor must proceed to the next rule.

2. Bed and Breakfasting Rule

This rule applies when an investor sells and then repurchases the same cryptocurrency within a 30-day period. The cost basis used to calculate gains or losses is based on the value of the assets purchased within this 30-day window. If the quantity sold exceeds the quantity repurchased within this timeframe, the investor must proceed to the final rule.

3. Section 104 Rule

This rule is applied when neither the Same-Day Rule nor the Bed and Breakfasting Rule are applicable to the transactions. Under the Section 104 Rule, an average cost basis is calculated for a pool of assets. This is done by summing the total amount spent on all assets in the pool and dividing it by the total quantity of coins or tokens held.

We highly recommend keeping thorough records of your trades using a crypto portfolio tracker!

Learn more about cost basis methods with easy to follow examples: UK Cost Basis Methods

How to Know if You Need to Pay Crypto Capital Gains Tax

First and foremost, you need to calculate the gain or loss for each cryptocurrency transaction you’ve made.

Typically, the gain is calculated as the difference between the selling price and the acquisition cost of the crypto asset. If you obtained the asset at no cost, you should use its market value at the time of acquisition for this calculation.

However, if you have already paid Income Tax on the value of the tokens, you are not required to pay Capital Gains Tax on that value. Nonetheless, any gain realised beyond the value on which Income Tax has been paid is subject to Capital Gains Tax.

When calculating your gain, you are allowed to deduct certain costs. This includes a portion of the pooled cost of your tokens, which is an aggregated cost basis used for assets of the same kind.

Additionally, if you have incurred capital losses, these can be utilised to offset your gains, reducing your Capital Gains Tax liability. It is crucial to report these losses to HMRC before applying them against your gains.

Read all about offsetting crypto losses: Claim Crypto Losses on Your UK Tax Return.

Finally, if the sum of your taxable gains exceeds the annual tax-free allowance for crypto, you are obligated to report these gains and pay Capital Gains Tax.

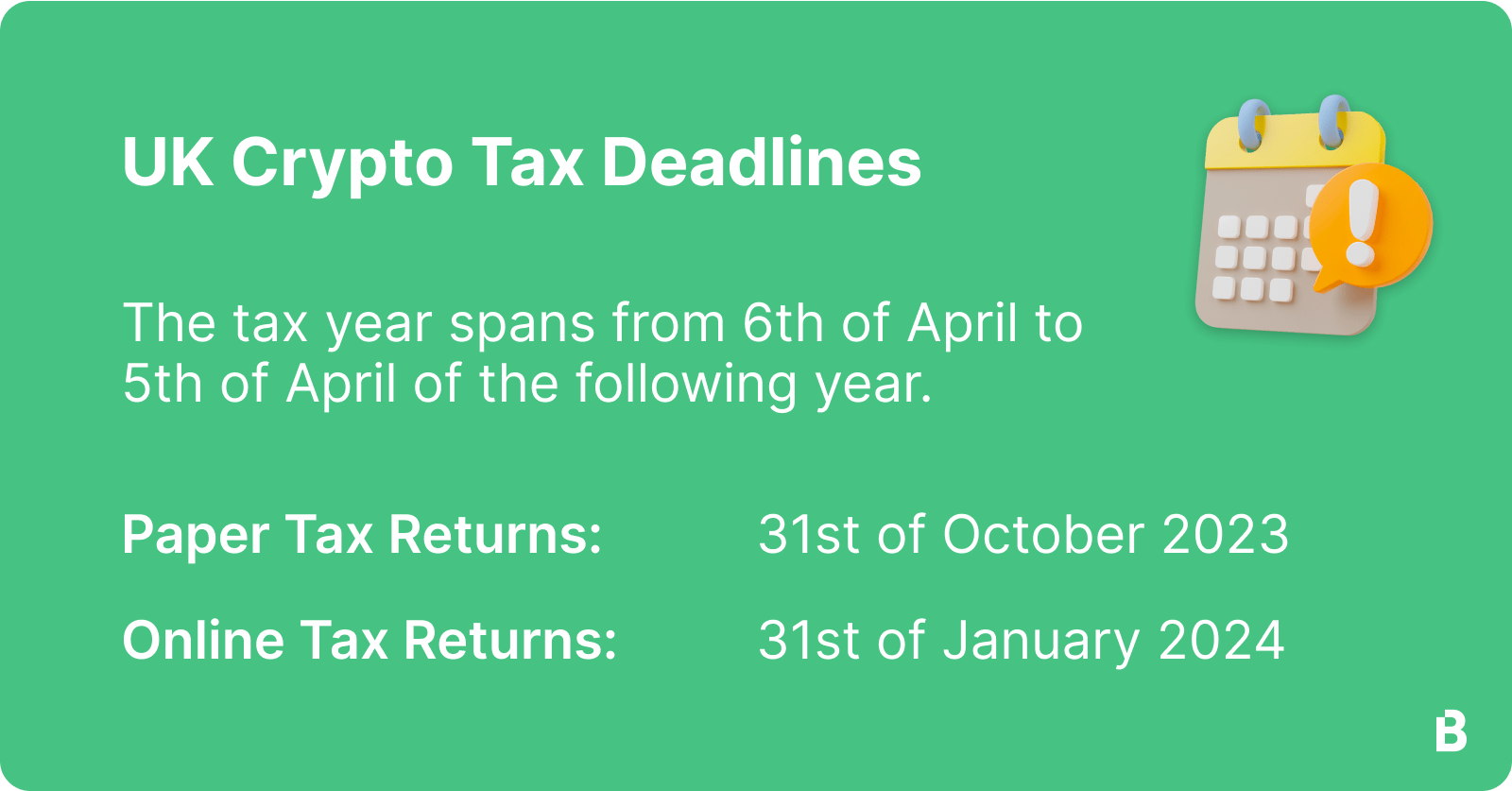

HMRC Crypto Tax Deadline

In the United Kingdom, the tax year spans from 6th April to 5th April of the following year. HMRC has set deadlines for filing tax returns and paying any taxes owed, including those on cryptocurrency gains:

- Paper tax returns need to be submitted by 31st October following the end of the tax year. As an example, if the tax year ends on 5th April 2023, paper tax returns must be in by 31st October 2023.

- When it comes to online tax returns, 31st January following the end of the tax year is the deadline. Using the same example, if the tax year ends on 5th April 2023, online tax returns should be filed by 31st January 2024.

How to Report Your Crypto Taxes to HMRC

Once you’ve calculated your gains or losses, it’s time to report them to HMRC. This can be done through a Self Assessment tax return.

- Register for Self Assessment: If you’re not already registered, you’ll need to sign up for Self Assessment. You can do this through the HMRC website.

- Fill in the Capital Gains Summary pages: In the tax return, you’ll need to complete the Capital Gains Summary pages, reporting the total gains or losses from all sources, including cryptoassets.

- Submit the Tax Return: You should submit your tax return online by 31st January following the end of the tax year. For example, for the tax year ending 5th April 2023, the deadline for online submission is 31st January 2024.

- Pay Any Tax Due: After submitting your tax return, you’ll need to pay any tax due. The deadline for payment is the same as the deadline for submitting the tax return.

File Your UK Crypto Tax Report Easily with Blockpit

Blockpit creates the most comprehensive crypto tax reports in PDF format. The report provides information about all your balances and transactions and can be used as proof of origin with banks or tax advisors. It contains all relevant transactions of your account in the selected tax year and provides detailed information such as timestamp, amount, asset, costs and fees of the individual transactions.

Using Blockpit couldn’t be easier:

1. Import your transactions

Blockpit offers direct integrations for crypto exchanges, wallets and DeFi protocols. Automatically import your transactions via API integration, wallet address synchronisation, or by manually uploading an Excel file.

Discover all crypto integrations

2. Validate & Optimise

Blockpit offers smart insights and suggestions to optimise your tax report, fix issues, add missing values and to validate your transactions.

3. Generate your tax report

Generate your compliant tax report with the click of a button. Our tax engine calculates your tax report on the basis of the UK tax framework.

{{cta-banner-tax-gb="/elements/reusable-components"}}

FAQ

What are cryptoassets?

Cryptoassets, commonly known as cryptocurrencies, are digital representations of value or contractual rights that use cryptography for secure transactions, and to control the creation of additional units. They operate on decentralised ledger systems called blockchains. Cryptoassets can serve various functions, including as a medium of exchange like traditional currencies, a means to execute smart contracts, or as tokens that represent underlying assets or interests.

Do I need to pay taxes on my crypto transactions in the UK?

Yes, in the UK you are required to pay taxes on certain crypto transactions. If you make profits from selling cryptoassets, you may need to pay Capital Gains Tax. If you receive cryptoassets as a form of payment or through mining, you may be subject to Income Tax and National Insurance contributions.

Is crypto taxed like stocks in the UK?

Yes, cryptoassets are in many ways taxed similarly to stocks in the UK, primarily through Capital Gains Tax. However, there are some differences. For example, when calculating gains for cryptoassets, pooling is used to calculate acquisition costs in some cases. This is akin to share pooling. Also, cryptoassets have unique events such as hard forks and airdrops, which have their own tax implications that don’t typically apply to stocks.

Which transactions are exempt from crypto taxes in the UK?

In the UK, not all crypto transactions are taxable. For example, simply holding your cryptoassets or transferring them between your own wallets does not trigger a taxable event. Gifting crypto to your spouse or civil partner is also exempt from Capital Gains Tax. Furthermore, each tax year there is a tax-free allowance, known as the Annual Exempt Amount.

What happens if I don’t report crypto gains or losses?

If you fail to report crypto gains or losses to HMRC, you could face penalties and interest charges on any unpaid taxes. HMRC is increasingly vigilant regarding crypto transactions, and not reporting can be seen as tax evasion.

Where can I find more information on crypto taxes in the UK?

For the most reliable and official information on crypto taxes in the UK, the HM Revenue and Customs (HMRC) website is the best resource. HMRC has published guidance on the tax treatment of cryptoassets.